The 6-Minute Rule for Clark Wealth Partners

Not known Facts About Clark Wealth Partners

Table of ContentsFascination About Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersClark Wealth Partners - TruthsGetting My Clark Wealth Partners To WorkClark Wealth Partners Fundamentals Explained

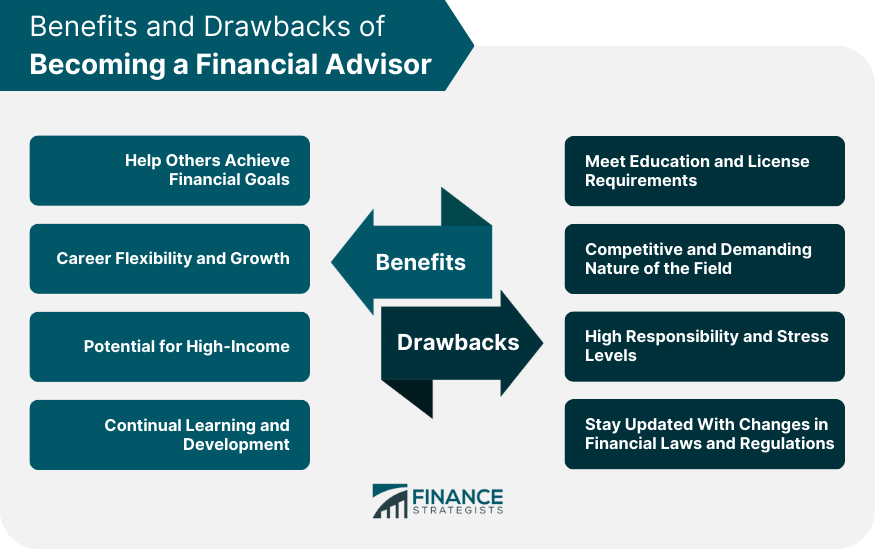

Merely put, Financial Advisors can take on component of the responsibility of rowing the boat that is your economic future. A Financial Expert ought to collaborate with you, not for you. In doing so, they should work as a Fiduciary by putting the most effective interests of their customers over their very own and acting in great belief while providing all pertinent facts and staying clear of problems of interest.Not all partnerships are effective ones. Possible negatives of functioning with an Economic Expert consist of costs/fees, high quality, and potential abandonment. Disadvantages: Costs/Fees This can easily be a positive as high as it can be a negative. The trick is to see to it you get what your pay for. The claiming, "price is an issue in the absence of value" is precise.

Truly, the objective should be to seem like the guidance and service got are worth even more than the expenses of the connection. If this is not the situation, then it is an unfavorable and therefore time to reconsider the partnership. Cons: Quality Not all Monetary Advisors are equivalent. Equally as, not one advisor is perfect for every possible customer.

A Biased View of Clark Wealth Partners

A client should constantly have the ability to answer "what happens if something happens to my Financial Expert?". It begins with due diligence. Always properly veterinarian any Financial Consultant you are considering functioning with. Do not depend on ads, awards, qualifications, and/or recommendations only when seeking a partnership. These ways can be utilized to limit the swimming pool no question, yet after that handwear covers need to be placed on for the remainder of the work.

when interviewing experts. If a specific area of competence is required, such as dealing with executive compensation strategies or establishing retirement for small company proprietors, discover experts to interview who have experience in those arenas. Once a relationship starts, stay invested in the partnership. Collaborating with a Financial Advisor needs to be a partnership - Clark Wealth Partners.

It is this kind of effort, both at the begin and with the partnership, which will assist accentuate the advantages and hopefully minimize the drawbacks. Do not hesitate to "swipe left" numerous time prior to you ultimately "swipe right" and make a solid link. There will be a price. The duty of a Financial Expert is to assist customers develop a plan to satisfy the financial objectives.

That task consists of fees, often in the forms of asset monitoring costs, payments, planning charges, financial investment product charges, etc - financial advisors illinois. It is very important to understand all fees and the framework in which the expert operates. This is both the responsibility of the expert and the client. The Financial Consultant is responsible for giving worth for the charges.

Not known Details About Clark Wealth Partners

Planning A organization plan is vital to the success of your business. You require it to understand where you're going, how you're getting there, and what to do if there are bumps in the roadway. A good monetary advisor can assemble a comprehensive plan to assist you run your service extra successfully and plan for anomalies that develop.

Minimized Anxiety As an organization owner, you have great deals of points to worry around. An excellent financial expert can bring you peace of mind knowing that your funds are obtaining the focus they need and your cash is being spent wisely.

Third-Party Viewpoint You are totally spent in your business. Your days are full of decisions and concerns that influence your firm. In some cases entrepreneur are so concentrated on the everyday grind that they lose view of the huge picture, which is to make a profit. An economic advisor will certainly take a look at the overall state of your financial resources without obtaining emotions involved.

A Biased View of Clark Wealth Partners

There are many advantages and disadvantages to take into consideration when employing a monetary consultant. First and foremost, they can supply useful proficiency, specifically for intricate financial preparation. Advisors offer individualized strategies tailored to private objectives, possibly bring about better financial results. They can additionally reduce the tension of handling investments and monetary choices, giving satisfaction.

The price of employing an economic consultant can be substantial, with costs that might affect general returns. Financial planning can be overwhelming. We suggest talking with an economic consultant.

It just takes a couple of mins. Take a look at the advisors' profiles, have an initial contact the phone or introduction in person, and select that to function with. Discover Your Consultant Individuals transform to financial consultants for a myriad of factors. The possible advantages of working with an advisor consist of the know-how and understanding they supply, the customized suggestions they can offer and the long-lasting discipline they can inject.

10 Simple Techniques For Clark Wealth Partners

Advisors are skilled specialists who stay updated on market trends, financial investment approaches and financial laws. This expertise allows them to supply understandings that might not be easily noticeable to the typical individual - https://steeldirectory.net/details.php?id=348952. Their proficiency can aid you navigate complex financial circumstances, make informed decisions and potentially surpass what you would certainly accomplish by yourself